Thomas Lange

Velero Immobilien GmbH

“There is a simple reason why we hold Funk in such high regard as an insurance broker: we have the same goals. As an active asset manager, we not only want to keep our properties in good condition, but also to continuously improve them. One thing is particularly important to us: implementing exactly those measures that the tenants really need. Our contact persons at Funk take the same approach: The insurance solutions are individually adapted to our company, are regularly checked and optimized if necessary. No matter which area of insurance is involved, we always receive competent and personal advice – from our responsible customer advisor as well as from the specialist departments. And if there's ever an urgent problem, there's always someone on the spot, quickly and without fuss. In short, we can rely on Funk – just as our tenants rely on Velero.”

Thomas Lange

Managing Director/Co-CEO

Velero Immobilien GmbH

velero.com

Tanja Mangold

GEMÜ Group

“As the world market leader in the field of valve designs for sterile applications, it is important to us that our system solutions are tailored to the individual needs of our clients. We also place this demand on our own service providers. In the introduction of a global risk management software, Funk completely fulfilled our expectations here. The implementation was straightforward and very professional, and we had a direct contact person available at all times. Any problems could thus be solved quickly and flexibly. The software now enables us to work more closely with our subsidiaries - and has therefore demonstrably improved our processes.”

Tanja Mangold

Corporate Insurance and Risk Management Officer

GEMÜ Group

René Gansewig

Neuwoba

“As a housing cooperative, continuity is one of the values that are particularly important to us – in regard to our members, for whom we want to enable lifelong living, but also in our choice of professional partners. Funk has been supporting us in our insurance and risk management since 2013. I appreciate three aspects in particular about the cooperation: On the one hand, Funk is a professional service provider that not only knows our industry and its classic risks well, but also provides holistic advice on new challenges and looks beyond its own nose. On the other hand, the experts also look inwards: For example, our internal processes have been significantly optimised by linking an insurance module to our ERP system. This module is also used for the lean processing of claims. When things get complex, though, our Funk contact is also there for us personally. It is precisely this open communication that ensures that we always find the best possible solution together – and that shows: Neuwoba is not just a number for Funk, but an equal partner.”

René Gansewig

Executive spokesman

Dr. Franz Radatz

Radatz Feiner Wiener Fleischwaren GmbH

„For more than 10 years we have been working in close cooperation with Funk and are very satisfied with the advice and support we receive. We appreciate Funk's knowledge of the risks of the food industry combined with a profound assessment of the insurance market. As a customer, you can not only count on our experience in the insurance sector, but valuable information is also always available for the areas of fire protection and safety engineering, based on the many years of experience of Funk's employees.”

Dr. Franz Radatz

CEO

Hanspeter Gauer

Polycontact AG

“Of particular interest to our company was the analysis we conducted together with Funk regarding uninsurable risks. This provided important information for the risk management of an automotive supplier. In addition, we were supported very professionally and with incredible ambition in the event of a major loss. As a broker with an international footprint, Funk has the appropriate size and weight with the insurers.”

Hanspeter Gauer

CEO

Polycontact AG

The complete German testimonial of Polycontact AG is available as a video here.

Edith Bieri

Foundation Educational and Residential Home Rossfeld

“Funk enormously takes the pressure off our internal processes. In addition, the advice provided by Funk supports the medium-term planning of our insurance portfolio. Our contacts at Funk examine even unusual requests and submit an offer or viable alternatives. This is a decisive factor, because we are always faced with completely new insurance questions.”

Edith Bieri

Director

Foundation Educational and Residential Home Rossfeld

Jörg Franzen

GESOBAU AG

“As a municipal housing company and lessor, we have a very special social responsibility when it comes to caring for and maintaining our apartments. Funk provides the best support for meeting our obligations. The international insurance broker and risk consultancy firm takes care of our complete insurance programme for our buildings. And we can rely on an extremely efficient digital claims management system. As a result, our insurance partner provides us with a service that is indispensable when it comes to offering our tenants the good service they have come to expect. And based on regular tendering for broker services, we are also confident that we are being offered cost-effective, market-value prices.

In addition, Funk's support of the respective insurance awarding is always extremely professional. The joint workflow with Funk is fast, efficient and uncomplicated.”

Jörg Franzen

Director of Service & Investment

GESOBAU AG

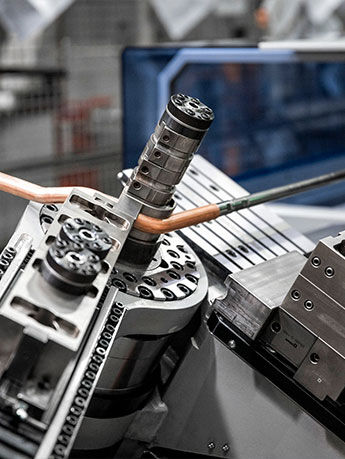

LEONI

2017

Web-based training on the topic of product liability

Product liability is a central topic in the automotive industry. Employee training that increases risk awareness and teaches the right conduct in this field is thus an integral component of risk management for this industry. The same applies for cable specialist and Funk customer LEONI.

However, increasing international growth has made it more and more complicated for LEONI to implement this training throughout its network. The corporate group has therefore joined forces with Funk to develop an e-learning tool, enabling employees throughout the company to learn about issues relating to product liability. This solution is flexible, efficient and not bound to a particular time or location.

Funk now also offers the ‘e-learning@Funk’ e-learning platform to other companies, meaning that small to medium-sized companies can also benefit from cost-effective mobile learning.

Adi Stuber

Olma Fairs St. Gallen

“Thanks to our long-standing cooperation, Funk knows our special requirements for insurance solutions for our annual ten or so trade fairs and over 100 events. Since the Funk team is also happy to be our guests during the eleven OLMA days, they can judge very well how everything from the St. Gallen bratwurst to the pork specialty ‘Bundesratssäuli’ must be properly insured. As a typical SME, we cannot cover the insurance know-how ourselves and are therefore happy to rely on experienced, qualified experts.”

Adi Stuber

Vice Director

Olma Fairs St.Gallen

Dirk Lütje

CITTI / CHEFS CULINAR

“We were impressed with how Funk carried out an excellently prepared plausibility check on our insurance package. We have been a satisfied customer ever since – they are a perfect fit, not just in technical terms but also on a personal level. Even as we engage in the international expansion of our business, with a particular focus on Scandinavia, Funk remains a reliable and competent partner with the necessary expertise when it comes to national requirements.”

Dirk Lütje

Managing Director

CITTI / CHEFS CULINAR

David Kubala

Kansai Helios Coatings GmbH

“How is good service different from excellent service? Good partners provide good services – excellent partners stand out in particularly difficult situations with outstanding support and problem-solving competence. Funk has presented itself as an excellent partner in the design of our international insurance programmes – although Helios, as a chemicals producer with a focus on Eastern and Central Europe, is not necessarily a valued customer in the insurance industry. In addition to our special risk profile, Funk has handled the complex insurance policies in many countries outside the EU with excellence and actively supported us in the settlement of claims. We appreciate the extremely fast and flexible communication and the high level of expertise of the entire Funk team.”

David Kubala

CEO

Armacell

2017

Value chain as a success factor

A robust delivery chain is of crucial importance to the financial success of a company. Armacell is therefore teaming up with Funk to introduce business continuity management (BCM) at its site in Münster. As Armacell processes chemical substances, the company is subject to the German Hazardous Incident Ordinance (StörfallV) – this means that important foundations for effective business continuity management (BCM) are already in place. In collaboration with Funk, detailed business continuity plans will be developed on the basis of these foundations. A life cycle will be developed and implemented over a period of around a year.

Within the scope of this life cycle, factors that impact on the Armacell value chain will be identified and analysed at regular intervals. In a further step, emergency plans triggered under realistic circumstances will be implemented in the company. This ensures that the value chain will remain robust in response to a crisis event.

Prior to the introduction of BCM, the company needs to make an important strategic decision and take into consideration the necessary consequences and provisions: how quickly does production need to be ready for action once again following a failure of any kind? The shorter the restart target that is planned for the business processes, the more comprehensive the business continuity measures that will need to be implemented.

This fundamental decision is taken as the basis for analysing the business processes and investigating the typical hazards at the site in question.

“In Funk, we have a coach that presents the advantages and essential features of BCM to us with a practical orientation. We are going through the BCM life cycle step by step as part of a joint process and benefiting from Funk’s project experience in the field of business continuity management”, says Salvatore Gargallo, Group EHS Manager at Armacell.

Swiss South Eastern Railway

2010

Negotiations on equal terms

A collision between a fast train of the Swiss South Eastern Railway (SOB) and a three-wheeled motorcycle, a so-called trike, developed into a complex insurance case in autumn 2010. The rider of the motorcycle had touched a crash barrier and was thrown off, but his trike went down a slope and only came to a halt on a track. Fortunately, no one was injured, but there was a high level of material damage to the train and tracks of over two million Swiss francs. At first it seemed clear that the rider of the trike would have to pay for the costs. But since 2010, the situation looks a bit different: That year, a revision of the Swiss Railway Act took place, which states that due to the operational hazards arising from railway operations, railway companies must be liable without fault not only for personal injury but now also for property damage. Therefore, although the SOB had nothing to reproach itself for, the new liability regulation meant that the SOB was to share in the property damage it had suffered itself. “With this case of damage, we were probably one of the first railway companies that had to experience the tightening of the legislation one-to-one,” says Marianne Reisner-Schmid, member of the management board at SOB. “Funk guided us safely and reliably through the negotiations thanks to their extensive experience and specialist expertise. Since Funk also enjoys a high level of respect among insurers, we were able to conduct our negotiations on equal terms – and conclude them with a very satisfactory result for SOB.” Because instead of the basic rule of the liability quota, according to which the railway company has to contribute two thirds of the property damage, Funk was able to achieve, by referring to cantonal and federal court decisions and with the help of its own lawyer, that the trike driver's liability insurer had to take over the main part of the property damage. The SOB was thus able to spare its own insurance policy for the most part, and discussions about possible premium increases were not an issue.

Dr Björn Carsten Frenzel

Aurubis AG

“For more than 20 years Funk has helped us equip ourselves with the ideal insurance setup, both nationally and internationally. As a global company, we especially appreciate the excellent work of the Funk Alliance network. We know our insurance management is in good hands.”

Dr Björn Carsten Frenzel

Head of Group Legal /

Corporate Governance

Aurubis AG

Schöck Bauteile

2017

Risk management as corporate added value

Risk management is more than adherence to statutory regulations. Schöck Bauteile has shown how risk management can be used to promote corporate success. In an initial step, a team established risk fields in relation to the board divisions and business units. During this process, Schöck received support from Funk Risk Consulting.

The identified risks included economic fluctuations and raw material prices, along with increasing requirements in terms of energy standards, different construction methods in international markets and a skills shortage.

Working together with Funk Risk Consulting, the Schöck team used these findings to develop a process that requires prominent risks to be identified and evaluated at a risk management meeting held twice a year. The results will then be assessed by the Executive Board and the Supervisory Board. The project participants will hold regular discussions with departmental managers and members of the Executive Board for the purpose of evaluating changes to the risk fields and analysing individual risks along with their measures.

Rainer Schapfeld, Head of Legal and Risk Management at Schöck Bauteile, sums the solution up as follows: “This type of risk management, which enables efficient recording, evaluation, processing and reporting of risks, provides a complete overview of the corporate risk situation when used alongside other controlling instruments.”